Healthcare

Capital Markets

|

|

|

|

|

|

|

New construction starts rose in last 12 months after COVID pause

|

|

|

|

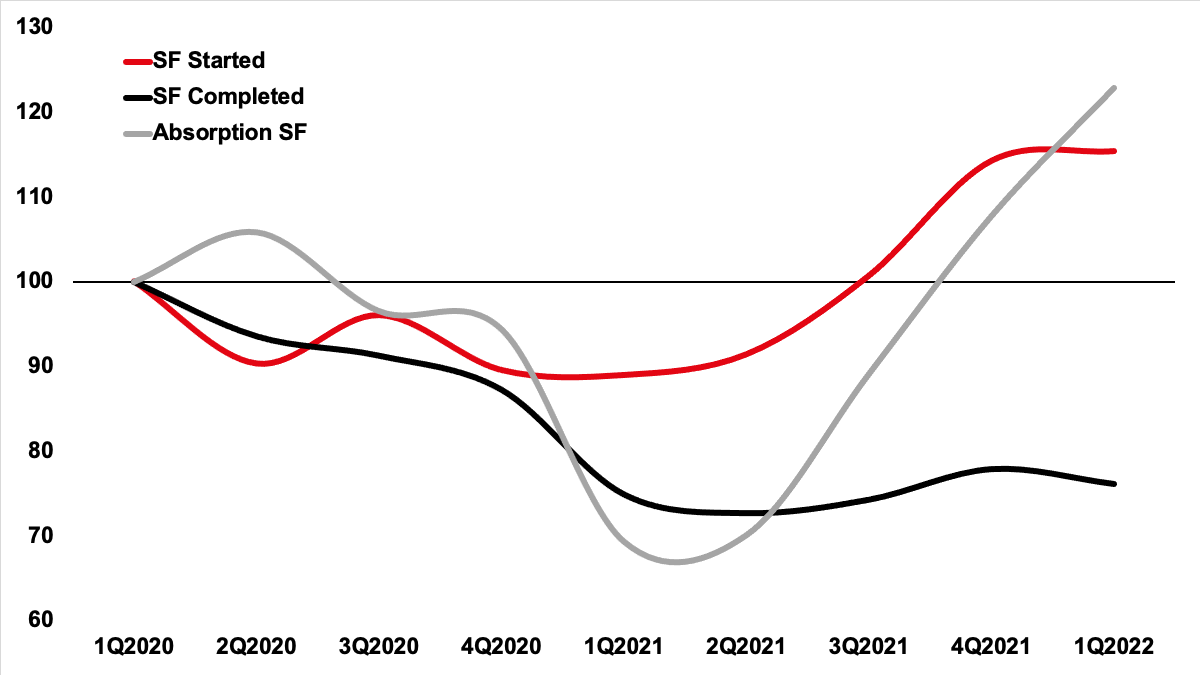

Medical office starts, completions and absorption, trailing four quarters,

indexed to Q1 2020

|

|

|

|

|

|

|

- Medical office construction starts have rebounded in the last four quarters as healthcare providers gain confidence in the need to expand the number and clinical intensity of sites for outpatient care. The pandemic put a spotlight on the need to move outpatient care out of the inpatient environment. There was an understandable pause in outpatient construction starts in the first 12 months of the pandemic. Outpatient volumes suffered initially and were accompanied by a slowdown in completions of medical office projects underway as well as delays in openings. However, healthcare providers’ confidence resumed early in 2021 as vaccines became available, leading to restoration of outpatient growth.

- Absorption rates for available medical office space tell a similar tale. Going into 2020, as reported by Revista, absorption of new medical office space exceeded all historical rates. Previously, MOB absorption was typically less than 10 million square feet a year. 2020 started off with record absorption - trailing four quarter rates in 2020 ranged from 14.2 to 15.6 million square feet, peaking in the second quarter of 2020 as the pandemic commenced. As the nation adapted to the pandemic in 2021 and restored in-person care, space absorption resumed its accelerating trend, slowly building from 10.5 million square feet to a record 15.9 million square feet. Absorption continued to build in 2022, with a new record of 18.5 million square feet on a trailing four quarter basis, nearly two times the typical rate going back to 2019 and earlier.

- The juxtaposition of slowing construction starts during the pandemic and higher rates of absorption meant that national occupancy rates for medical office crept up, albeit gradually. Medical office occupancy which has hovered between 91 and 92 percent occupancy for nearly two decades, moved gradually from 91.3 percent in Q1 2020 to 91.7 percent in Q1 2022.

- Along with that steady climb in occupancy, medical office rent growth, year over year, continued to build at a consistent rate of around 2 percent a year. New construction rents are increasing, especially for projects started in the second year of the pandemic when construction costs took off. However, given that new supply is a minor 1.5 percent of inventory, the impact of new construction rents on overall sector rent growth is not measurable for now.

- Looming concerns of recession are rising and hot property sectors such as industrial have started to show signs of slower growth. Medical office, however, tends to be recession-resistant, remaining stable during times of economic crisis, as demonstrated over the past two years. The critical nature of the services conducted in medical office space as well as the growing and aging demographics linked to demand for healthcare means medical office performance will likely remain steady in the event of any adverse economic trend.

|

|

|

|

|

To learn more about JLL’s Debt Market Insights for Medical Office, click here:

|

|

|

|

|

|

|

New Listing - Investment Sale

|

|

1 Seymour Plaza

126,358 s.f.

Montclair, NJ

|

New Listing - Investment Sale

|

|

The Ella at Carillon

125,254 s.f.

Largo, MD

|

|

|

|

New Listing - Investment Sale

|

|

Commonwealth of Virginia Medical Office Building

40,303 s.f.

Richmond, VA

|

New Listing - Investment Sale

|

|

Surgical Center of Connecticut

28,680 s.f.

Bridgeport, CT

|

|

|

|

|

|

|

Wisconsin Children’s MOB Portfolio

111,827 s.f.

Milwaukee & Green Bay areas

|

|

|

|

Fresenius 2-pack

21,056 s.f.

Charlotte, NC

|

|

|

|

Crossroads Professional Center

53,128 s.f.

Ellicott City, MD

|

|

|

|

Want to receive more deal opportunities? Register for the JLL Investor Center, our new portal offering secure and easy access to our global inventory of investment opportunities.

From any device, anywhere in the world, you can search and view listings, receive invitations to private listings, and edit your preferences so you only receive opportunities that meet your specific criteria. Register for the Investor Center here>

|

|

|

|

|