Healthcare

Capital Markets

|

|

|

|

|

|

|

Medical office investment trends bode well for record year in 2021

|

|

|

|

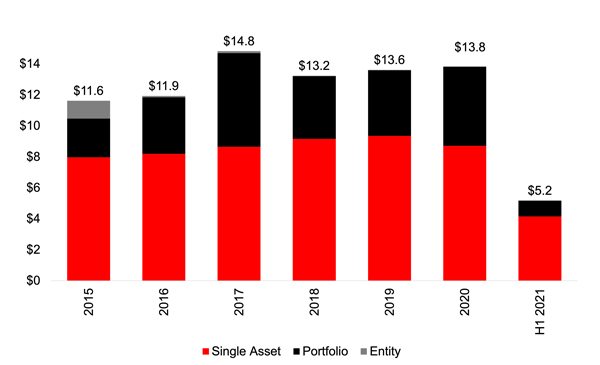

Medical office sales ($ billions)

|

|

|

|

|

Source: JLL Research, RCA

|

Key points:

- While first half medical office sales in 2021 were muted due to a slow start in 2021, JLL research shows reasons for optimism for another record sales year rivaling or exceeding the recent 4-year average of nearly $14 billion. First half sales were $5.2 billion, approximately 40% of average annual volume, boding well for the full year as the second half typically drives 60% or more of yearly activity. Single asset sales in the first half at $4.2 billion exceeded the first half 2020 level and should rival or exceed the peak 2019 level based on JLL’s pulse on market activity.

- Notably, sales of major portfolios in the first half were spare. However, JLL forecasts total portfolio volume in 2021 of nearly $6 billion in aggregate, based on deals that have closed in the second half, are under contract, and in advanced offer rounds. The $6 billion level rivals the 2017 record. However, 2017 included the outsized $2.9 billion sale of the Duke Realty healthcare properties, comprising nearly half of the activity. With portfolio sales typically contributing 40% of total sales, there is reason to suggest that total sales volume will be record breaking in 2021. JLL’s optimism is supported by nearly $3 billion in healthcare property capital markets transactions closed by the firm year to date.

- In spite of and because of the COVID era, investor interest in this asset class is swelling and truly hitting its stride with healthcare properties’ long-term, reliable income generation. New entrants piled into the asset class, which was fortified by the strong operational performance of medical office tenants during COVID with high rent collections at 99%, combined with continued high average occupancy of 92.0% and no deterioration in rent levels. Major institutional investors Nuveen and Wafra, to name a few - have made big splashes in 2021 through major portfolio acquisitions and/or recapitalizations. Stay tuned for announcements of other new players in healthcare in the months ahead, often household institutional names, as more major portfolios trade. Institutional investment drives liquidity and sale prices in real estate sectors.

- The solid and stable performance of medical office has solidified this defensive asset class in investors’ views and attracted new investment capital even in the face of remarkable global economic strain.

|

|

|

|

New Listing - Investment Sale

|

|

Ardent Medical Office Portfolio

762,780 s.f.

Texas & Kansas

|

New Listing - Investment Sale

|

|

University of Kansas Health System Great Bend Medical

63,978 s.f.

Great Bend, KS

|

New Listing - Investment Sale

|

|

Patriot Plaza

65,658 s.f.

Hackettstown, NJ

|

|

|

|

|

|

|

Arkansas Heart Hospital

159,196 s.f.

Little Rock, AR

|

|

|

|

Omega Healthcare

77,511 s.f.

Rockville. MD

|

|

|

|

Auldern Academy

20,400 s.f.

Siler, NC

|

|

|

|

|

|

|

|

Want to receive more deal opportunities? Register for the JLL Investor Center, our new portal offering secure and easy access to our global inventory of investment opportunities.

From any device, anywhere in the world, you can search and view listings, receive invitations to private listings, and edit your preferences so you only receive opportunities that meet your specific criteria. Register for the Investor Center here>

|

|

|

|

|