Healthcare

Capital Markets

|

|

|

|

|

|

|

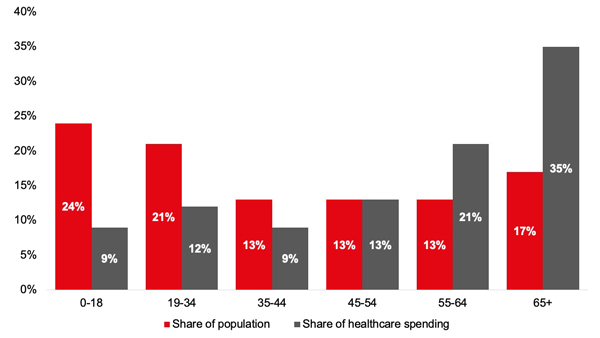

People want to live longer, healthier lives; aging population drives demand for healthcare, especially among older cohorts

|

Age of Population vs. Healthcare Expenditure

|

|

Source: Advisory Board, Kaiser Family Foundation analysis of Medical Expenditure Panel Survey

|

|

|

|

- The biggest consumers of U.S. healthcare services are the 55+ age cohort, accounting for the majority of healthcare spending at 56%, yet older residents make up only 30% of the population. This group accounts for 4 out of 5 inpatient admissions and they go to the doctor twice as much as younger adults.

- With national healthcare spending accounting for 18.2% of GDP, this means an astonishing 1 out of every 10 dollars in today’s economy is going to serve the healthcare needs of people 55 years and older.

- If we consider that the older population is growing from 46 million residents in 2020 to 80 million in 2050, the demand for healthcare services will be outsized. Healthcare as a percent of GDP is continuing to climb, projected at 19% in the near term by 2025, but with the healthcare expenditures forecasted to grow 31% from 2020 to 2025, the nominal growth in healthcare dollars spent will be extraordinary. Outpatient demand for ages 55+ alone is forecasted to grow 16.9% by 2025, a rate that is 4.3% higher than the general population.

- Demand for outpatient medical real estate will be fueled by the demand factors underlying this older cohort – growth in sheer numbers of the older population, longer life expectancy aided by advances in medicine and life sciences and healthcare delivery allowing for more outpatient care - reinforcing medical office as one of the most stable asset classes.

|

|

|

|

|

|

for making JLL Capital Markets the

#1 Healthcare capital markets advisor 2018-2021

|

|

|

|

$4.1B

2021 healthcare real estate transaction volume

|

$2.9B

2021 investment sales & advisory and equity placement

|

$14.6B

2018-2021 medical office and hospital transactions

|

|

|

|

Note: Ranking is for medical office and hospital facilities only; medical office data provided by Real Capital Analytics

Based on combined 2018-2021 transaction volumes for Jones Lang LaSalle Americas, Inc. (“JLL”)

|

|

|

|

New Listing - Investment Sale

fff

|

|

Atrium Health Medical Office Portfolio

62,372 s.f.

Charlotte, NC

|

Closed - Investment Sale &

Debt Placement

|

|

Granger Medical Clinic

94,834 s.f.

West Valley City, UT

|

Closed - Debt Placement

fff

|

|

Brunswick Hospital

109,115 s.f.

Amityville, NY

|

|

|

|

|

|

|

University of Kansas Health System Great Bend Hospital

63,978 s.f.

Great Bend, KS

|

|

|

|

Patterson Place Duke MOB

60,500 s.f.

Durham, NC

|

|

|

|

Kansas City MOB Portfolio

50,469 s.f.

Kansas City metro area

|

|

|

|

Closed - Investment Sale

fff

|

|

Wexford Medical Center

44,772 s.f.

Wexford, PA

|

Closed - Investment Sale &

Debt Placement

|

|

Milford Regional Health Complex

38,401 s.f.

Northbridge, MA

|

Closed - Investment Sale

fff

|

|

Sugar Land Medical Plaza

37,133 s.f.

Sugar Land, TX

|

|

|

|

|

|

|

TLC Medical Arts Building

28,712 s.f.

Lady Lake, FL

|

|

|

|

Dialysis Portfolio

22,120 s.f.

Logan, UT & Chubbuck, ID

|

|

|

|

Want to receive more deal opportunities? Register for the JLL Investor Center, our new portal offering secure and easy access to our global inventory of investment opportunities.

From any device, anywhere in the world, you can search and view listings, receive invitations to private listings, and edit your preferences so you only receive opportunities that meet your specific criteria. Register for the Investor Center here>

|

|

|

|

|