Healthcare

Capital Markets

|

|

|

|

|

|

|

Medical office development showcases solid growth and sector fundamentals

|

|

|

|

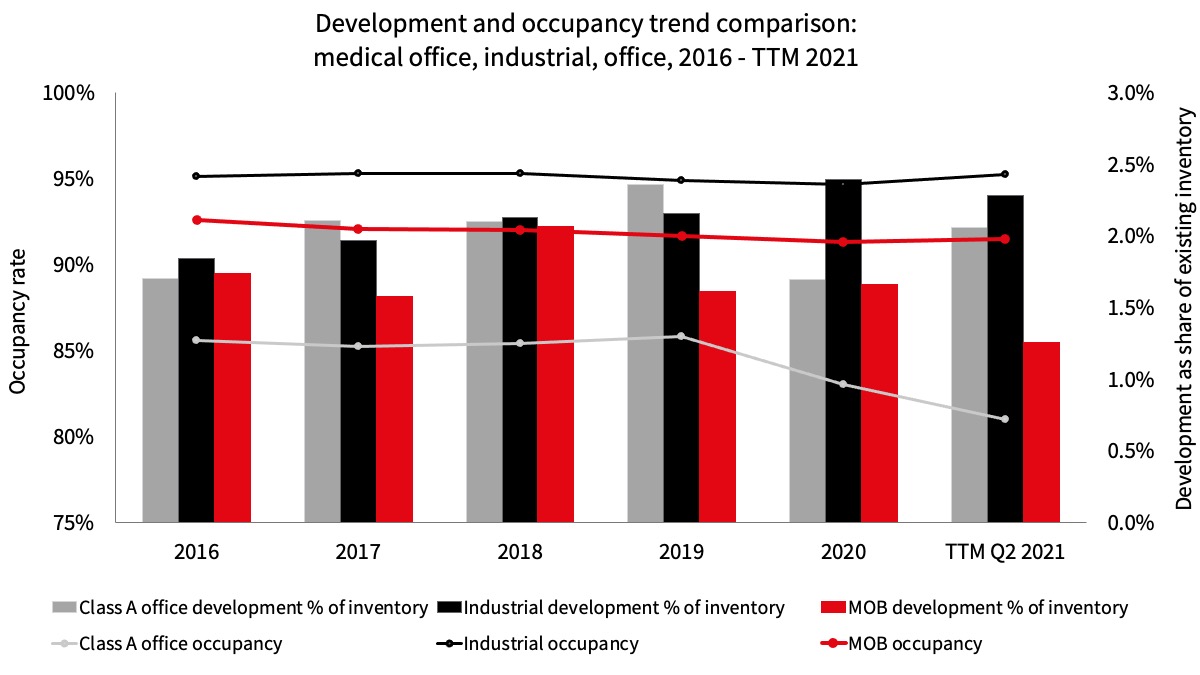

MOB development remains steady and disciplined, supported by robust occupancy, and limited speculative development

|

|

|

|

|

Source: JLL Research, Revista

|

Key points:

- New medical office development deliveries in the top 100 U.S. metros averaged 17.3 million square feet annually during the period from 2016 to 2020, representing an average 1.7 percent of medical office inventory totaling 1.0 billion square feet. The consistent pattern of demand-driven development in outpatient medical properties, that are substantially pre-leased and with an increasing percentage of single-tenant projects, illustrates the steady investment profile in this stubbornly stable property class. Occupancy, net operating income and rent collections have been exceptionally consistent and high for outpatient medical properties through every economic cycle, including during the onset of the global pandemic in 2020.

- Development statistics in medical office contrast neatly with Class A office and industrial, which portrays a tale of two markets, reflecting changing dynamics in these property classes in the last five years. During the past five years, Class A office development has been delivered at a higher rate relative to inventory when compared to medical office, averaging 2.0 percent annually of its 2.6 billion square feet of inventory. The risk profile is elevated with substantial speculative development and larger overall projects, averaging just over 200,000 square feet per new project, versus new Class A medical office projects at a smaller 60,000 square feet and with substantial preleasing.

- Industrial development has been the cyclical winner, with positive growth trends dating to before the global pandemic. Development as a percent of the 14.2 billion square feet of inventory has grown steadily, from 1.5 percent in 2015 to 2.4 percent in 2020. This is remarkable growth and shows deliveries planned before the onset of the pandemic, fueled generally by the outsized growth of electronic commerce and logistics.

- Occupancy statistics tell a parallel and confirmatory story about the three property classes. Industrial occupancy was the highest during 2015 to 2020, at a consistent level of 95 percent annually and on average. Outpatient medical, similarly, has been stable at 92 percent on average. Office occupancy has averaged 85 percent but experienced a modest decline through the period, largely due to pandemic-related uncertainty about workplace strategies going forward.

- The contrast between these property classes ratifies the current investment thesis for essential real estate like industrial and medical office. While there is substantially more speculative development in industrial, factors such as the high demand for space, shorter time to delivery, and higher rent growth from releasing spreads, has captivated investors interested in seeking overall higher returns with perceived limits on risk. Office is no doubt in a transitory period with the stable state of the property class still unknown. Medical office is the steady eddy, with high durable occupancy and consistent, albeit lower, rent growth. Medical office is supported by a lower level of development and growth in inventory, protecting the interests of current owners of property as well as developers.

|

|

|

|

New Listing - Debt Placement

|

|

Upshot Medical Center at

Mills Park

156,566 s.f.

Orlando, FL

|

New Listing - Investment Sale

|

|

Newport Lido Medical Center

146,510 s.f.

Newport Beach, CA

|

New Listing - Investment Sale

|

|

Duke Medical Plaza at Patterson Place

59,978 s.f.

Durham, NC

|

|

|

|

New Listing - Investment Sale

|

|

Wexford Medical Center

44,772 s.f.

Wexford, PA

|

New Listing - Investment Sale

|

|

Fresenius NC-3 pack

33,870 s.f.

Charlotte & Kings Mountain, NC

|

New Listing - Investment Sale

|

|

Centennial Surgery Center

8,763 s.f.

Las Vegas, NV

|

|

|

|

Closed - Equity & Debt Placement

|

|

Project Lighthouse

545,813 s.f.

Multi-state

|

|

|

|

Excelsior Orthopedics Campus

99,160 s.f.

Amherst/Buffalo, NY

|

|

|

|

Parkway Medical Plaza

89,249 s.f.

Henderson, NV

|

|

|

|

|

|

|

|

Want to receive more deal opportunities? Register for the JLL Investor Center, our new portal offering secure and easy access to our global inventory of investment opportunities.

From any device, anywhere in the world, you can search and view listings, receive invitations to private listings, and edit your preferences so you only receive opportunities that meet your specific criteria. Register for the Investor Center here>

|

|

|

|

|